For example, they are based in Norwalk, Connecticut. The Priceline Group sits there, the largest online travel agency in the world. Operating in 200 countries, it made more than $9 billion in sales last year with a handful of websites called Booking.com, Agoda.com, or Kayak. But now the resistance is being formed against the online giants.

But Still: Is Online Booking Portal Good or Bad for Hoteliers?

Booking portals such as trivago or booking.com are an integral part of the hotel landscape. More and more bookings are done online. The presence on Internet portals ensures a higher occupancy rate for hoteliers. However, the trend also brings disadvantages.

Advantages of online booking portals

Hotel booking portals are an important distribution partner for the hotel industry, but as important as external agents in hotel sales are. The market power of some dominant booking portals must not lead to an abuse of market power in terms of commission levels and contractual terms. Booking portals have the clear advantage of a long reach, because the more hotels listed on a platform, the more users visit the portal – travelers from abroad will also be aware of the hotels. This range is not possible with the sales channels belonging to hotels. With booking portals, hotel managers can also reach potential customers who have not heard of these hotels abroad so far.

Moreover, booking portals help enormously to bring the last-minute actualities about the hotels at short notice with many bookings coming via hotel online booking sites the day before check-in.

Disadvantages for hoteliers

The large number of hotels that can be found on individual portals leads to an enormous price war within the industry. Guests are often looking for the cheapest price and tempting bargains. This means for hoteliers to have to offer reasonably priced room rates in order to be competitive. In addition to the fact, of course, that for each successfully mediated room, a commission must be paid. The result is financial losses or empty rooms. The commissions of up to 15% are not appropriate, as the profit margin is reduced too much.

Another disadvantage of booking portals is that hoteliers cannot communicate with future guests during the booking process. Travel booking process is carried out exclusively via a booking portal, which is also responsible for answering the questions during reservation process. The first personal contact to build up a long-term guest relationship is very important for an owner-managed hotel.

Challenges for the hotel industry

How is your situation? Haven’t you ever searched for a hotel for your vacation or business trip? While searching for a suitable hotel, the offers of booking portals are first to appear. Even if a potential customer is recommended a hotel and he or she enters this hotel in Google search, a booking portal in which a hotel is offered appears in the first instance. Booking portals are basically large databases that can schedule traveling in a few clicks. You enter when you want to travel with how many people, where, and get a list of available hotel rooms, flights or rental cars. The principle is simple, the success is immense. The Priceline Group, the German hotel agent HRS or Expedia are now some of the most used distribution channels for hotel rooms worldwide.

How Did It Happen?

The hotel industry has been facing great challenges for many years. Most of the developments are positive, but there are always changes that have a negative impact on the industry. Do you remember the best price guaranteed by booking.com? It was a promise that is still present in people’s minds today. Booking.com promised travelers a room rate that was nowhere to be found cheaper. Even on the hotel’s own website no room rates were negotiated, which undercut the prices of booking.com. The hoteliers were very limited in their pricing. Commission payments of up to 20% on the booking portals additionally presented the hoteliers with major challenges. The commission payments have not changed much.

Customers often strive only for the largest provider, so monopolies are created. Thus, Booking.com already has a major market share. From the customer’s point of view, the portals offer the lowest prices and do not cost them anything. Travel agents from the network do not operate their service for free. But they do collect some horrendous agency fees which customers do not pay, but hotels do. Online booking sites demand commissions of 15 to 25% of the room price from hotels.

Support from EU and HOTREC

At the end of 2015, the Hotel Association in Germany prohibited Booking.com to provide its customers with the best price guarantee. For the hotel industry, it was an important step in their freedom of choice. The hotels were allowed to design their own prices since that time. A big step was done.

The shortage of skilled workers in the hotel industry has become a major issue today, and the GDPR (General Data Protection Regulation) poses new challenges for hoteliers. For small and medium-sized hotels, a struggle for survival has begun in many cases.

On December 6th, 2018, a vote took place in the lead Internal Market Committee (IMCO) of the European Parliament. More transparency was requested between platforms such as Google, Amazon or Booking.com and their commercial users. The application was accepted and benefits the hotel industry.

Since December 17th, 2018, the umbrella Association of Hotels, Restaurants, Pubs and Cafes (HOTREC) offers startups on the online platform hospitality support. Startups can now present their services and their products in the European hospitality industry and make them visible. The conditions to reposition yourself in the hotel industry have never been better, especially in times of digitization, social media promise benefits in terms of implementation and marketing.

Booking.com Always Wants the Best Price

When hotels understood that some years ago, around 20 to 30% of room bookings came through the portals, and they became dependent on computers. It destroys margins in the long run and sharing with traditional hotel culture. But still small hotels depend on Booking.com, Expedia, HRS & Co and need them badly to bring their guests into the house. Many simply apply commissions to room rates.

Due to the lack of support from other colleagues, some hotel chain owners take action themselves. “Book directly, without online booking sites”, they appeal. Plus, they offer a fixed price that varies seasonally by a maximum of 10%. Through the portals, the complex service of a hotel operation is reduced to the price. In addition, portals lead hotel owners to so-called yield management. The latter do not like the fact that prices are sometimes adjusted to the demand every hour on the Internet; for the same room guests have to pay 50, sometimes 500 euros.

A hotelier who wanted to be listed with his house on Booking.com, for example, is not allowed to offer better prices and conditions on any other website, on any other booking portal or even on his own hotel website. Worldwide hotel associations saw an anti-competitive interference in the free pricing and prohibited only HRS, later Booking.com the so-called rate-parity clauses in the hotel contracts. This became a dispute that deals with courts today. Because market leader Booking.com did not want to accept the rules. The company was offered to soften the clauses a little.

Best Price Clause as the Most Important Business Model

In the headquarters of the parent company, the Priceline Group (Connecticut, the USA) communications chief Leslie Cafferty shakes head doubting the EU Hotel Association’s view that a rate-parity clause hinders competition. They believe that rate parity will create a level playing field for all market participants, and will thus ensure a fair competitive environment. After all, the hotels remained 100% free to set their own prices, she says. Besides, there is indeed no obligation to use Booking.com.

Booking.com management evidently suspects that without a best price clause, the whole business model of the booking portal would be jeopardized. Without the parity rate, hotels would be able to use booking portals as their free marketing platforms where they would display their offers, but then ask customers to make a direct booking. Such would allow hotels to enjoy huge marketing success without incurring associated fees and eat up the profits of the portals.

The German hotel association considers this to be exaggerated, although in Germany, the narrow parity clauses of Booking.com are prohibited.

Possible Alternatives

Meanwhile, there are also hoteliers who try to go other ways than online booking sites. Hotel directories are characterized by the fact that hoteliers benefit from a high range, manage the booking process themselves and, thus, no commissions are due. The corresponding concept was developed 20 years ago. Hoteliers who use it pay only a one-time annual fee for the listing. Commissions for the room bookings are not due. Guests go directly to the booking system of the desired hotel via website link – the host immediately receives the room request and can process it personally as well as communicate with the guests. The reservation of the hotel room is free, the payment for the stay is made in the hotel.

Recommendations for Hoteliers

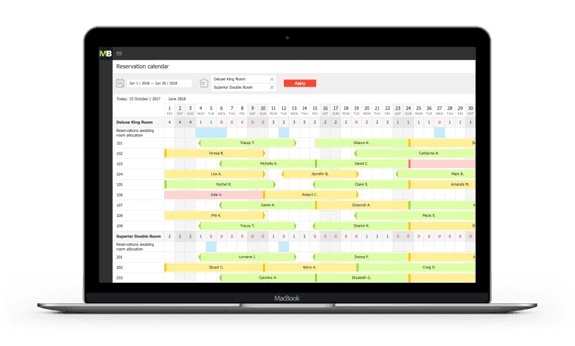

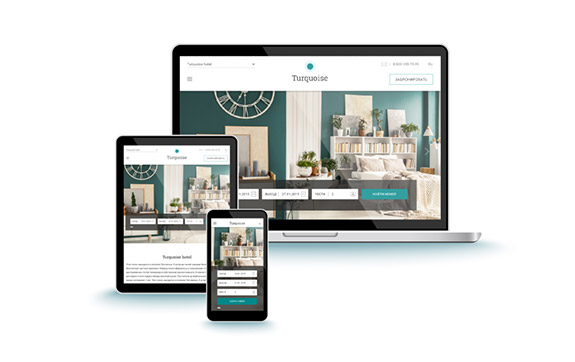

In the age of globalization and digitization, booking portals are indispensable in the market and with their high added value for hotels, their presence is justified. Hoteliers should make targeted use of these distribution channels. Nevertheless, a professional homepage with an optimized own booking engine (IBE) should be a standard for every hotel.

In addition, a further budget for online marketing should be well planned, as own sales activities are rarely cheaper than the listing in reservation systems. Own SEA, SEO or social media campaigns should have a very precise target group focus, so that the costs are below the 15 to 20% commission payment per booking.

Conclusion for Individual Hotels

For individual hotels, it can be a proven way to minimize one’e own online marketing budgets and rely on booking portals instead. Likewise, the establishment of incentive systems is recommended – with advantages and amenities for the existing circle of guests, to make them ideally direct bookers. One of the cooperation principles is that the hotel product should be competitive for booking listing and score points over competitors with excellent guest reviews and value for money. If these conditions are met, online booking sites can help achieve a tremendous presence and attention on the Internet.

Please, let us know if the article was useful for you and do not hesitate to leave your feedback.